Audit & AuditTech

Audit & AuditTech is a next-gen digital auditing solution developed to revolutionize traditional audit processes. Whether you’re a financial institution, cooperative society, or regulatory body, our platform empowers internal and external auditors with real-time, automated, and paperless audits that ensure full compliance and risk mitigation.

- Trusted by 300+ financial institutions worldwide

- Audit & AuditTech combines automation

- AI-driven insights for smarter decision-making and faster closure of audit findings

Key Features

Easily connects with core banking, MIS, DMS, and third-party ERP systems. Supports multi-branch, multi-entity audits.

End-to-End Digital Audit

Enables internal, concurrent, statutory, and regulatory audits reporting.

AI & BI-Powered Risk Intelligence

Detects anomalies using pattern recognition & ML-based risk scoring.

Regulatory Compliance

Ensures alignment with RBI, ICAI, IIA and international audit standards.

Benefits

Save 60% audit time

with automated workflows

Improve visibility

across branches and risk categories

Ensure zero data tampering

with immutable logs

Accessible from anywhere

anytime – even in remote areas

Who Can Use Audit & AuditTech?

Government and Private Sector Banks

Cooperative Banks & Societies

NBFCs, MFIs & Micro Credit Institutions

Regulatory & Statutory Auditors

Multi-Branch Corporate Enterprises

Your burning question, answered

Why should I care about financial planning?

What are the different types of investments?

How can I start saving for retirement?

What is the importance of emergency funds?

What can I use a personal loan for?

What is a personal loan?

What credit score is needed for a personal loan?

How much money can I get a personal loan for?

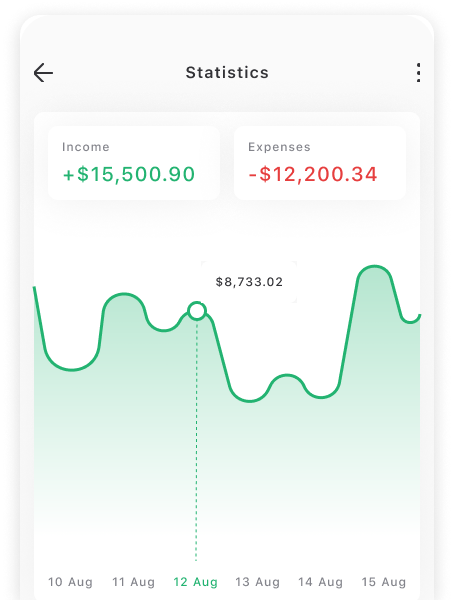

Digital banking, wherever life takes you

Download App

Download app. It will work for windows, Mac and androids.

01

Create Your Account

Secure online account opening, mobile banking.

02

Start Banking

Set up online banking and watch your money grow